AUSTIN, TEXAS (March 25, 2019) – FalconStor Software, Inc. (OTCQB: FALC), a market leader in software-defined storage and data management, today announced financial results for its fourth quarter ended December 31, 2018.

Key Financial Highlights for the Fourth Quarter of Fiscal 2018

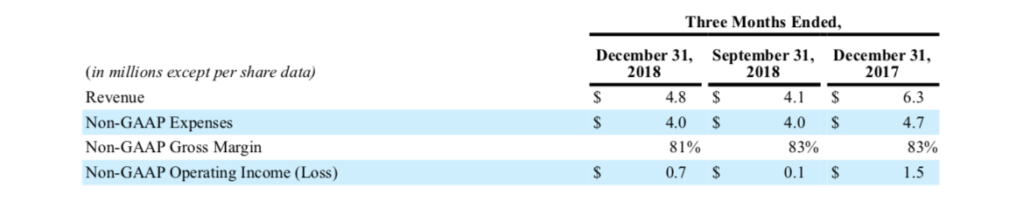

- Achieved Non-GAAP Operating Income of $0.7 million, marking the sixth consecutive quarter of Non-GAAP Operating profitability.

- On October 9, 2018, we closed on the final tranche of our previously announced Financing of Units, providing the Company an additional $1,000,000 of gross proceeds from new investors.

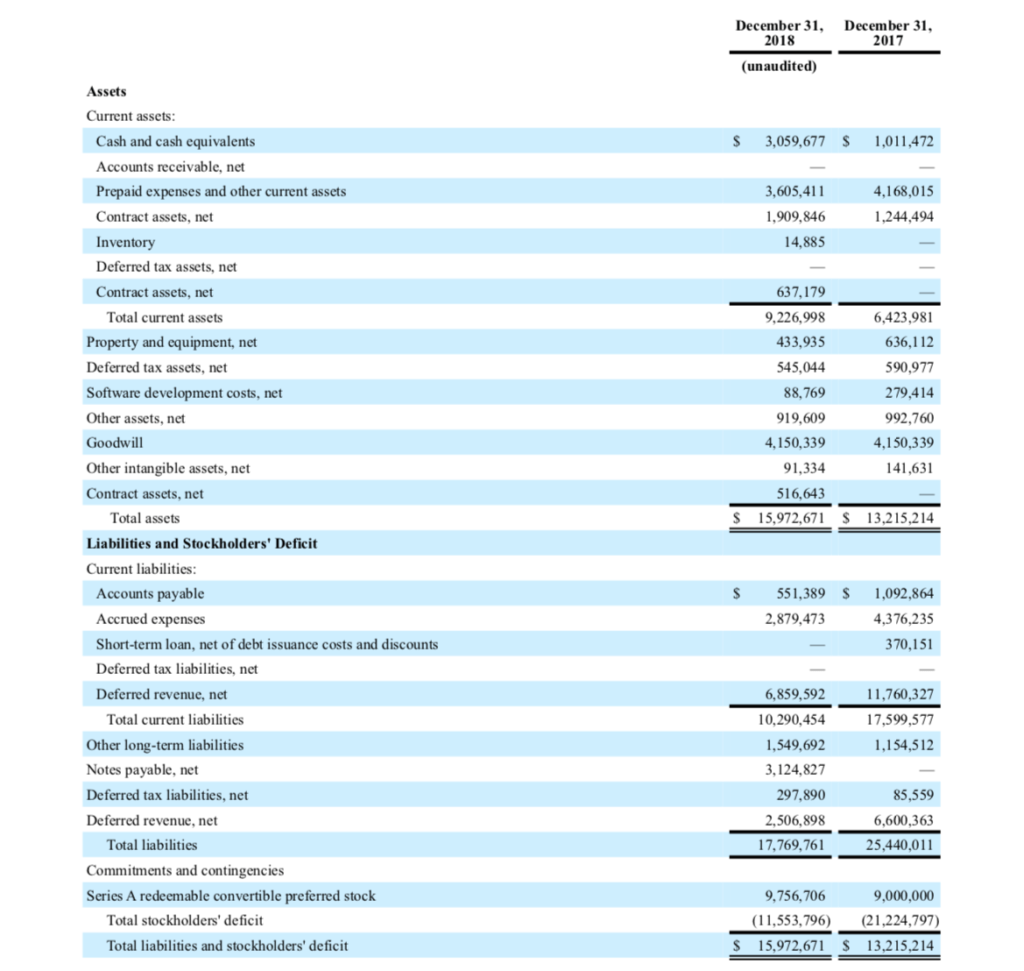

Cash and cash equivalents increased to $3.1 million from $1.0 million at December 31, 2017.

Key Highlights

- Our FreeStor solution was renamed FalconStor Data Mastery Platform to more accurately reflect the product’s full value proposition for large enterprises with complex IT environments. It includes native cloud functionality, newly validated for AWS and in the validation process for additional leading public cloud services.

- Our Virtual Tape Library with Deduplication solution was validated for AWS S3, enabling customers to migrate virtual tapes to AWS S3 object storage to achieve low-cost tape archive in the cloud.

- We have accomplished moving 100% of our go-to-market through the channel, and we are deepening our relationships with existing partners and recruiting and welcoming new partners.

“I am pleased with the operating profitability which continued through the fourth quarter, and the growth delivered in our Americas and EMEA regions.” said Todd Brooks, CEO FalconStor. “Momentum going into 2019 is positive as billings in our Americas and EMEA markets increased 21% and 40%, respectively, as compared to Q4 of 2017.”

Additional Financial Highlights for the Fourth Quarter 2018

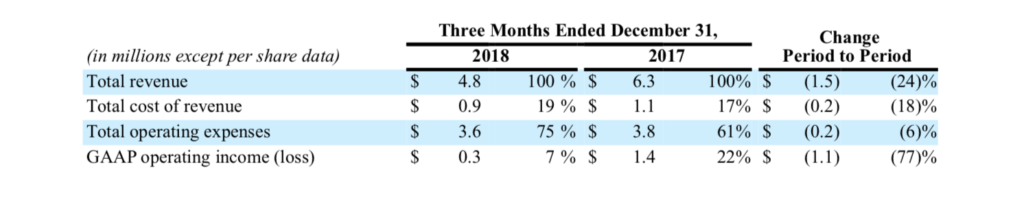

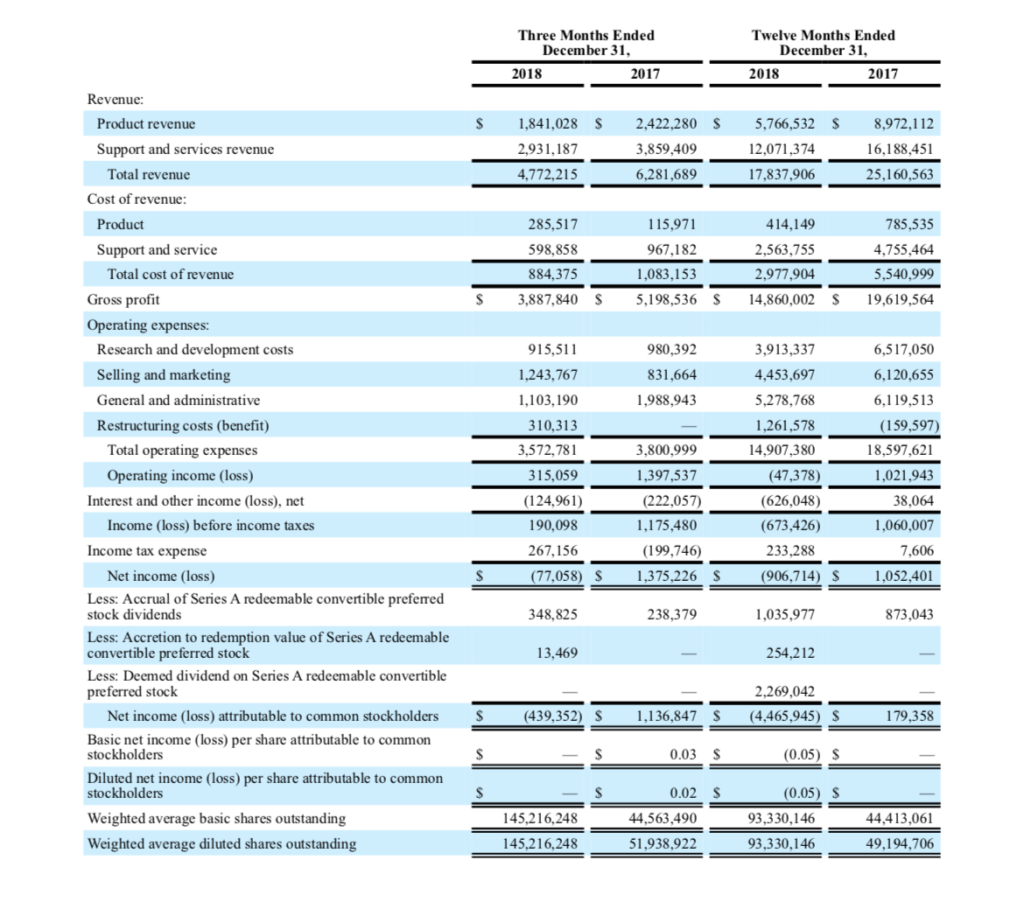

While our Non-GAAP Operating Income was $0.7 million for the quarter, we recorded a GAAP Net Loss for the three months ended December 31, 2018 of $0.4 million, as compared to GAAP Net Income of $1.1 million for the same period of the previous year, in part as a result of the impact of new revenue recognition guidance, in addition to other non cash restructuring charges incurred in connection with our cost reduction efforts.

Overall, total revenue for the three months ended December 31, 2018 was $4.8 million as compared to $6.3 million in the prior year period. This decline in revenue was significantly impacted by our adoption of new revenue recognition accounting guidance under Topic 606 on January 1, 2018 using the modified retrospective transition method, which resulted in a $1.2 million decrease in revenue.

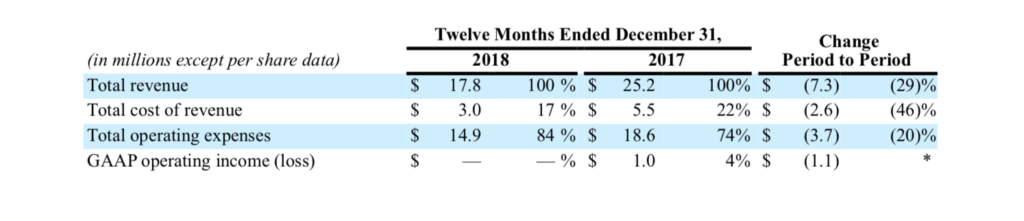

Net cash used by operations decreased by $1.1 million to $1.5 million for the twelve months ended December 31, 2018, as compared to $2.6 million of net cash used by operations for the twelve months ended December 31, 2017.

We ended the quarter with $3.1 million of cash and cash equivalents, as compared to $1.0 million at December 31, 2017.

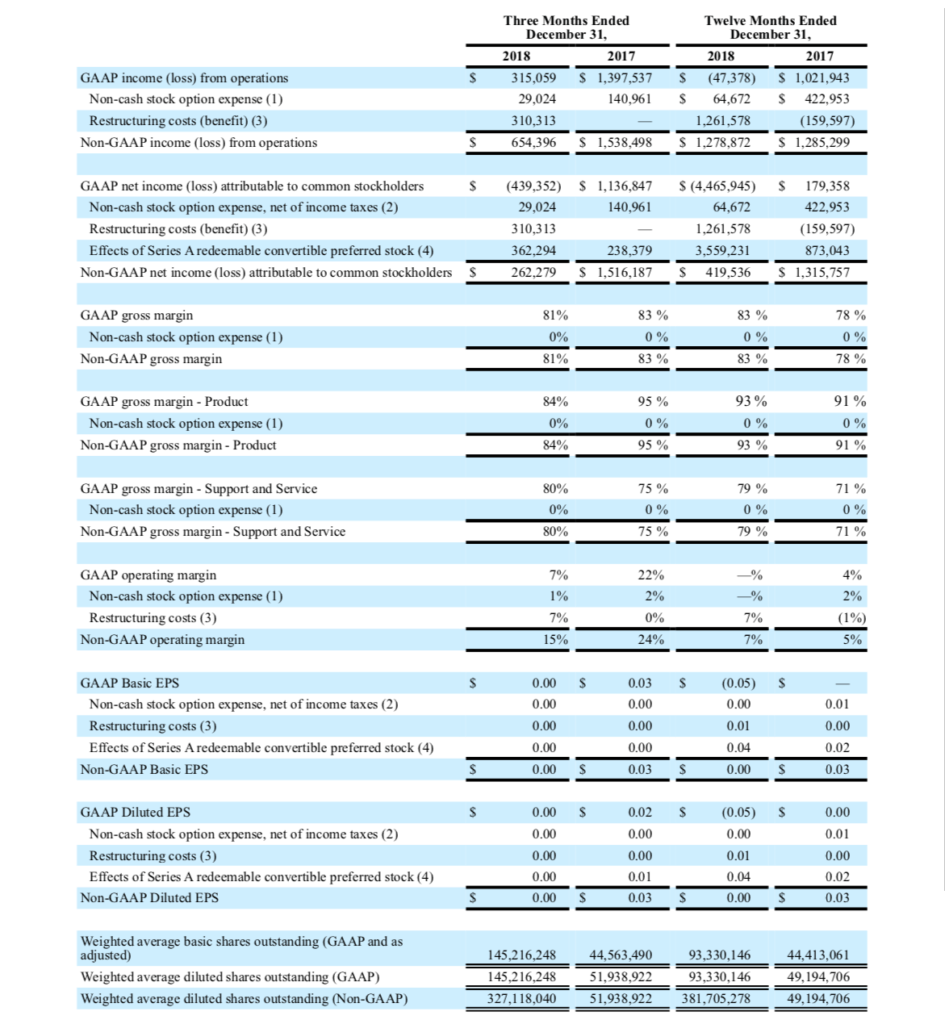

Non-GAAP results above exclude the effects of stock-based compensation, restructuring costs and the effects of our Series A redeemable convertible preferred stock. A reconciliation between GAAP and non-GAAP information is provided on page 6 of this release.

Conference Call and Webcast Information

The Company will host a conference call to discuss its financial results on Monday, March 25, 2019 at 3:30 p.m. CDT. To participate in the conference call, please dial:

Toll Free: 1-800-458-4121

International: +1-323-794-2093

Conference ID: 6222316

To view the presentation, please copy and paste the following link into your browser and register for this meeting. Once you have registered for the meeting, you will receive an email message confirming your registration.

FALCONSTOR FOURTH QUARTER 2018 FINANCIAL TELECONFERENCE AND PRESENTATION

A conference call replay will be available beginning March 25th at 6:30 PM CDT through 6:30 PM CDT on April 1st. To listen to the replay of the call, dial:

Toll Free: 1-888-203-1112

International: 1-719-457-0820

Passcode: 6222316

Non-GAAP Financial Measures

The non-GAAP financial measures used in this press release are not prepared in accordance with generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. The Company’s management refers to these non-GAAP financial measures in making operating decisions because they provide meaningful supplemental information regarding the Company’s operating performance. In addition, these non-GAAP financial measures facilitate management’s internal comparisons to the Company’s historical operating results and comparisons to competitors’ operating results. We include these non-GAAP financial measures (which should be viewed as a supplement to, and not a substitute for, their comparable GAAP measures) in this press release because we believe they are useful to investors in allowing for greater transparency into the supplemental information used by management in its financial and operational decision-making. The non-GAAP financial measures exclude (i) restructuring costs, (ii) effects of our Series A redeemable convertible preferred stock, and (iii) non-cash stock-based compensation charges and any potential tax effects. For a reconciliation of our GAAP and non-GAAP financial results, please refer to our Non-GAAP Operating Data GAAP Reconciliation, presented in this release.

About FalconStor Software

FalconStor Software, Inc (OTCQB: FALC ) empowers IT professionals to achieve mastery of their data – an organization’s most precious asset – so they can responsibly push the boundaries of what’s possible in the digital economy. The company’s award- winning flagship solution, FreeStor®, is a modern, comprehensive and easy-to-use global data mastery software platform that gives IT professionals centralized data management control across all their resources to reduce operational costs, lower risk, and avoid technology compromises. FalconStor’s vendor- and hardware-agnostic solutions are designed to work with existing investments across complex environments, including legacy data centers, hyper-converged infrastructure, cloud, and hybrids.

Founded in 2000, FalconStor is headquartered in Austin, Texas and has additional offices in New York, Europe and Asia. Our solutions are available and supported by a vast network of system integrators and resellers. For more information, please visit www.falconstor.com.

###

FalconStor and FalconStor Software are trademarks or registered trademarks of FalconStor Software, Inc., in the U.S. and other countries. All other company and product names contained herein may be trademarks of their respective holders.

Links to websites or pages controlled by parties other than FalconStor are provided for the reader’s convenience and information only. FalconStor does not incorporate into this release the information found at those links nor does FalconStor represent or warrant that any information found at those links is complete or accurate. Use of information obtained by following these links is at the reader’s own risk.

CONTACT INFORMATION

For more information, contact:

Brad Wolfe

Chief Financial Officer FalconStor Software Inc. investorrelations@falconstor.com

FalconStor Software, Inc. and Subsidiaries CONDENSED CONSOLIDATED BALANCE SHEETS

FalconStor Software, Inc. and Subsidiaries CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

FalconStor Software, Inc. and Subsidiaries Reconciliation of GAAP to Non-GAAP Financial Measures (Unaudited)

Footnotes:

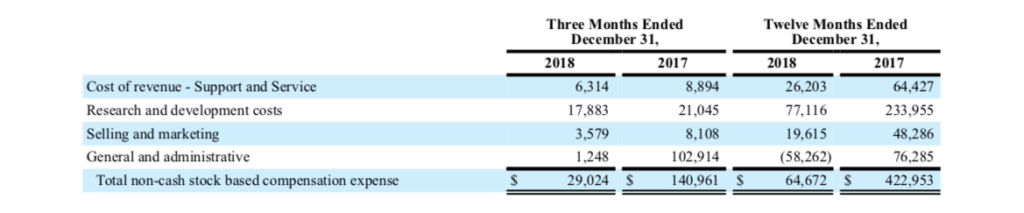

(1) Represents non-cash, stock-based compensation charges as follows:

(2) Represents the effects of non-cash stock-based compensation expense recognized, net of related income tax effects. For the twelve months ended months ended December 31, 2018 and 2017, the tax expense for both GAAP and Non-GAAP basis approximate the same amount.

(3) Represents restructuring costs which were incurred during each respective period presented.

(4) Represents the effects of the accretion to redemption value of the Series A redeemable convertible preferred stock, accrual of Series A redeemable convertible preferred stock dividends and deemed dividend on Series A redeemable convertible preferred stock.