AUSTIN, TX, March 22, 2018 — FalconStor Software, Inc. (OTCQB: FALC), a market leader in storage software, today announced financial results for its fourth quarter and fiscal year ended December 31, 2017.

“Q4 continues the return to profitability first delivered in Q3 2017, and powered the company to an annual profit for 2017, the first since 2008. This performance further demonstrates the stability our strategic restructuring is creating” stated Todd Brooks, CEO of FalconStor. “In addition to the improved operating performance, the increased engagement we experienced in Q4 with our global partner and end-user base has been encouraging, and has created momentum to support our growth and product innovation efforts.”

Mr. Brooks added “despite the improved operating results, the Company’s cash position continued to deteriorate in 2017. Accordingly to facilitate the ability of the Company to continue in operations and implement its turn-around strategy, the Company closed on the previously announced Commitment with Hale Capital.” Mr. Brooks further noted “that the implementation of the turn-around strategy is further enhanced by the June 30, 2021 maturity date for the Commitment and the agreement of Hale Capital Partners as part of the Commitment to postpone the fixed date for mandatory redemption requests on the Company’s Series A redeemable preferred stock to July 30, 2021.”

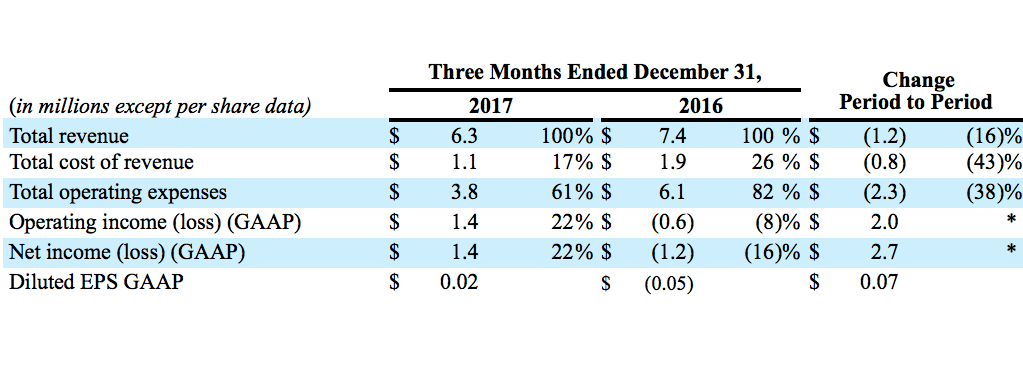

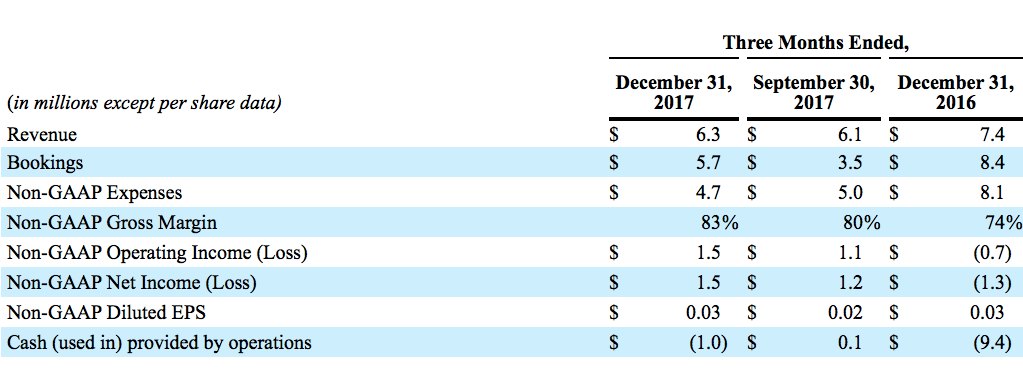

Financial Overview

For the three months ended December 31, 2017 we delivered net GAAP operating income of $1.4 million on revenues of $6.3 million. Included in operating results above for the three months ended December 31, 2017 and 2016 were $0.1 million and $(0.1) million of share-based compensation expense, respectively, and $0.2 million and $0.3 million of severance expense, respectively.

For the twelve months ended December 31, 2017 we have delivered GAAP net operating income of $1.0 million as compared to a net operating loss of $10.3 million for the same period last year. Included in operating results above for the twelve months ended December 31, 2017 and 2016 were $0.4 million and $2.3 million of share-based compensation expense, respectively, and $1.2 million and $1.7 million of severance expense, respectively. Included in net income (loss) for the twelve months ended December 31, 2017 and 2016 was an income tax provision of $0.0 million and $0.6 million, respectively. Due to cost reduction initiatives during 2017 we improved net income by $12.1 million for the twelve months ended December 31, 2017 as compared to the prior year period.

Deferred revenue at December 31, 2017 was $18.4 million, compared with $23.7 million at December 31, 2016. Our cash balance at December 31, 2017 was $1.0 million, compared with $3.4 million at December 31, 2016.

In June 2017, our Board of Directors, approved a comprehensive plan to increase operating performance (the “2017 Plan”). The 2017 Plan has resulted in a realignment and reduction in workforce and a change in the leadership of the Company. The 2017 Plan is substantially complete and we ended the quarter with 81 employees worldwide. In connection with the 2017 Plan, the Company has incurred severance expense of $1.2 million. In making these changes, we prioritized customer support and development while consolidating operations and streamlining direct sales resources, therefore allowing us to focus on our install base and develop more efficient market channels.

During 2017, we continued to innovate and further enhance our products.

Non-GAAP results exclude the effects of stock-based compensation, restructuring costs and the effects of our Series A redeemable convertible preferred stock. A reconciliation between GAAP and non-GAAP information is provided on page 7 of this release.

Closing Commitment

As previously announced, In February 2018, the Company and HCP-FVA, LLC (“HCP-FVA”) entered into the Amended and Restated Loan Agreement and closed on a previously announced Commitment whereby HCP-FVA agreed to provide an aggregate of $3,000,000 of financing (inclusive of the Bridge Loan described below) to the Company. As part of the Commitment, the Company issued HCP-FVA additional Backstop Warrants to purchase 41,577,382 shares of Common Stock at a nominal exercise price and Financing Warrants to purchase 366,990,000 shares of Common Stock at a nominal exercise. The Company previously issued 13,859,128 Backstop Warrants to HCP-FVA in connection with a $500,000 Bridge Loan provided by HCP-FVA in November 2017.

The Company intends to offer to FalconStor stockholders as of November 17, 2017 who are accredited investors the opportunity to purchase Units consisting of Financing Warrants, Senior Secured Debt and Series A redeemable convertible preferred stock held by HCP-FVA. For more information concerning the commitment and the financing, please see the Company’s Form 8-K filed February 26,2018.

Company Headquarters

The Company has been transitioning the movement of its principal executive officers to 823 Congress Avenue, Suite 1300, Austin, Texas 78701. This transition has been completed and going forward the Company’s public filings will reflect this new address as the Company’s principal executive officers. The Company continues to retain its officers in Melville, New York and is actively seeking to sublet a significant portion of its Melville office space.

Conference Call

The Company will host a conference call to discuss its financial results on Thursday, March 22, 2018 at 4:30 p.m. EDT. To participate in the conference call, please dial:

Toll Free: 1-800-289-0438

International: +1-323-994-2083

Conference ID: 5521730

To view the presentation, please copy and paste the following link into your browser and register for this meeting. Once you have registered for the meeting, you will receive an email message confirming your registration.

https://www.falconstor.com/FalconStor-Q4-2017-Earnings-Call-Registration

Meeting: FalconStor Q4 2017 Earnings

Meeting Password: Q417meeting

Meeting Number: 793 135 872

A conference call replay will be available beginning Thursday, March 22, 2018 at 7:30 p.m. EDT through 7:30 p.m. EDT on March 29, 2018. To listen to the replay of the call, dial: Toll Free: 1-888-203-1112; International: +1 719-457-0820; Passcode: 5521730

Non-GAAP Financial Measures

The non-GAAP financial measures used in this press release are not prepared in accordance with generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. The Company’s management refers to these non-GAAP financial measures in making operating decisions because they provide meaningful supplemental information regarding the Company’s operating performance. In addition, these non-GAAP financial measures facilitate management’s internal comparisons to the Company’s historical operating results and comparisons to competitors’ operating results. We include these non-GAAP financial measures (which should be viewed as a supplement to, and not a substitute for, their comparable GAAP measures) in this press release because we believe they are useful to investors in allowing for greater transparency into the supplemental information used by management in its financial and operational decision-making. The non-GAAP financial measures exclude (i) restructuring costs, (ii) effects of our Series A redeemable convertible preferred stock, and (iii) non-cash stock-based compensation charges and any potential tax effects. For a reconciliation of our GAAP and non-GAAP financial results, please refer to our Non-GAAP Operating Data GAAP Reconciliation, presented in this release.

About FalconStor Software

FalconStor Software, Inc. (OTCQB: FALC) is a leading storage software company offering a converged data services software platform that is hardware agnostic. Our open, integrated flagship solution FreeStor® reduces vendor lock-in and gives enterprises the freedom to choose the applications and hardware components that make the best sense for their business. We empower organizations to modernize their data center with the right performance, in the right location, all while protecting existing investments. FalconStor’s mission is to maximize data availability and system uptime to ensure nonstop business productivity while simplifying data management to reduce operational costs. Our award-winning solutions are available and supported worldwide by OEMs as well as leading service providers, system integrators, resellers and FalconStor. The Company is headquartered in Austin, TX. with additional offices in Melville, N.Y., and throughout Europe and the Asia Pacific region. For more information, visit falconstor.com or call 1-866-NOW-FALC (866-669-3252).

Follow us on Twitter – Watch us on YouTube – Connect with us on LinkedIn

# # #

This press release includes forward-looking statements that involve risk and uncertainties that could cause actual results to differ materially from the forward-looking statements. These risks and uncertainties include: delays in product development; market acceptance of FalconStor’s products and services; technological change in the data protection industry; competition in the data protection market; results and costs associated with governmental investigations; intellectual property issues; and other risk factors discussed in FalconStor’s reports on Forms 10-K, 10-Q and other reports filed with the Securities and Exchange Commission.

FalconStor, FalconStor Software, FreeStor and Intelligent Abstraction are trademarks or registered trademarks of FalconStor Software, Inc., in the U.S. and other countries. All other company and product names contained herein may be trademarks of their respective holders.

Links to websites or pages controlled by parties other than FalconStor are provided for the reader’s convenience and information only. FalconStor does not incorporate into this release the information found at those links nor does FalconStor represent or warrant that any information found at those links is complete or accurate. Use of information obtained by following these links is at the reader’s own risk.

Click here for financial information. (PDF)