Continued Strategic Progress, Including New Growth Equity Raise

AUSTIN, TEXAS (August 4, 2021) – FalconStor Software, Inc. (OTCQB: FALC), a trusted data protection leader modernizing backup and archival solutions for the multi-cloud world, today announced financial results for its second quarter and first half of fiscal year 2021, which ended on June 30, 2021.

“We continue to make good progress against our strategic plans to reinvent FalconStor, enhance the value we deliver to our customers, and innovate within the cloud-based data protection market,” said Todd Brooks, FalconStor CEO. “While we were disappointed that our second quarter total revenue declined year-over-year by 6.9%, total revenue for the first half of 2021 increased year-over-year by 6.1%. Over the next year, we expect our year-over-year quarterly revenue growth to continue to stabilize as our sales pipeline becomes more predictable, and we expand our markets.”

“Migration to the cloud, data center rationalization and infrastructure optimization are top priorities for enterprise CIOs in the post-pandemic world, and FalconStor plays a vital role in each,” added Brooks. “Our market, strategic focus, and results over the last three years allowed us to successfully raise $4 million in new growth equity since the beginning of the second quarter of 2021. We are excited by the trust our shareholders have placed in our team to deliver customer and shareholder value.”

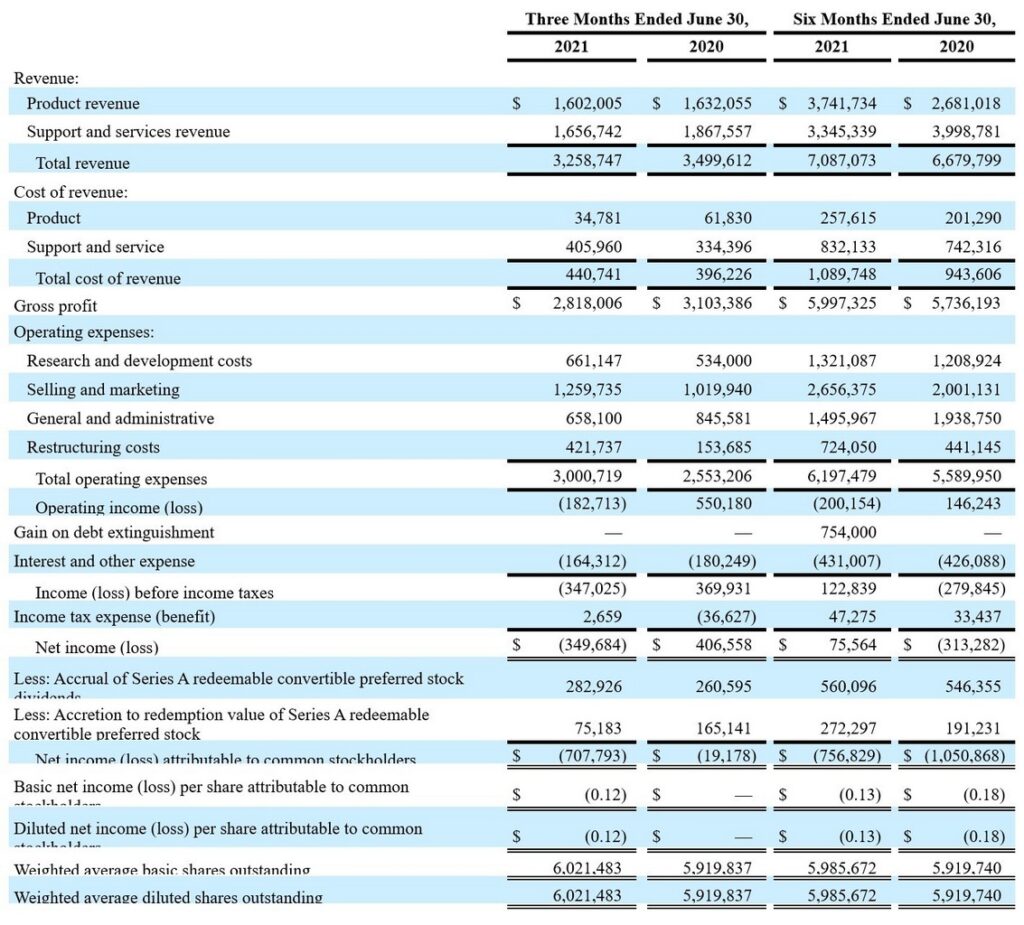

Second Quarter 2021 Financial Results

• Product Revenue: 2% product revenue decline to $1,602,005, compared to $1,632,055 in the second quarter of fiscal year 2020

• New Customer Billings: $1,938,863, compared to $1,915,199 in the second quarter of fiscal year 2020

• Total Revenue: $3.3 million, compared to $3.5 million in the second quarter of fiscal year 2020

• Total Cost of Revenue: $0.4 million, compared to $0.4 million in the second quarter of fiscal year 2020

• Total Operating Expenses: $3.0 million, compared to $2.6 million in the second quarter of fiscal year 2020

• GAAP Net Income (Loss): $(0.3) million, compared to $0.4 million in the second quarter of fiscal year 2020

• Ending Cash: $3.7 million, compared to $1.5 million in the second quarter of fiscal year 2020

First Half 2021 Financial Results

• Product Revenue: 40% product revenue increase to $3.7 million, compared to $2.7 million in the first half of fiscal year 2020

• New Customer Billings: $1,500,540, compared to $1,469,815 in the first half of fiscal year 2020

• Total Revenue: $7.1 million, compared to $6.7 million in the first half of fiscal year 2020

• Total Cost of Revenue: $1.1 million, compared to $0.9 million in the first half of fiscal year 2020

• Total Operating Expenses: $6.2 million, compared to $5.6 million in the first half of fiscal year 2020

• GAAP Net Income (Loss): $0.1 million, compared to $(0.3) million in the first half of fiscal year 2020

• Ending Cash: $3.7 million, compared to $1.5 million in the first half of fiscal year 2020

Second Quarter 2021 Business Highlights

• Delivered updates to our next-generation long-term data retention and recovery technology in StorSafe, built with a bridge to all industry-leading public clouds for long-term archival optimization, including AWS, Microsoft Azure, IBM Cloud, and Wasabi

• Continued our win trajectory in IBM environments, specifically IBM I and AS/400 system implementations

• Continued to deliver value to our Managed Service Provider business partners, with our trusted partner BlueChip growing to 300 customers and 4 petabytes of data under management.

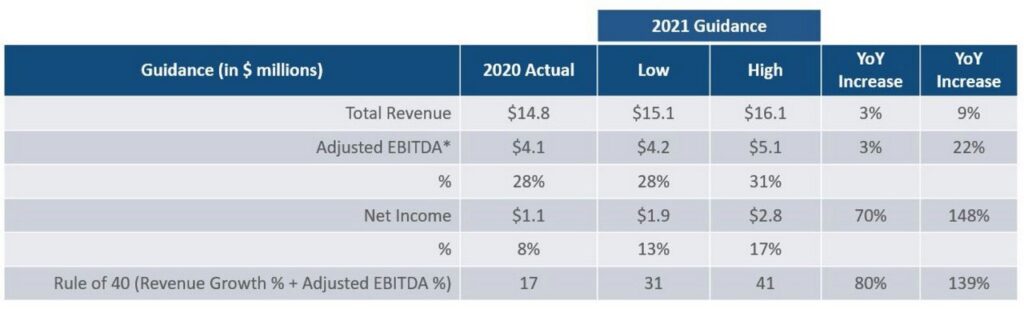

Guidance

We are affirming the 2021 guidance we have previously provided.

Conference Call and Webcast Information

WHO:

Todd Brooks, Chief Executive Officer, FalconStor and Brad Wolfe, Chief Financial Officer, FalconStor

WHEN:

Wednesday, August 4, 2021, 4:00 P.M. Central Time

To register for our earnings call (or to view the recording afterwards), please click the following link:

FALCONSTOR SECOND QUARTER 2021 FINANCIAL TELECONFERENCE AND PRESENTATION

As an alternative, you can copy and paste the following link into your web browser to register:

https://register.gotowebinar.com/register/5598359582179255563

Conference Call:

Please dial the following if you would like to interact with and ask questions to FalconStor hosts:

Toll Free: 1-877-309-2074

Access Code: 613-637-608

Non-GAAP Financial Measures

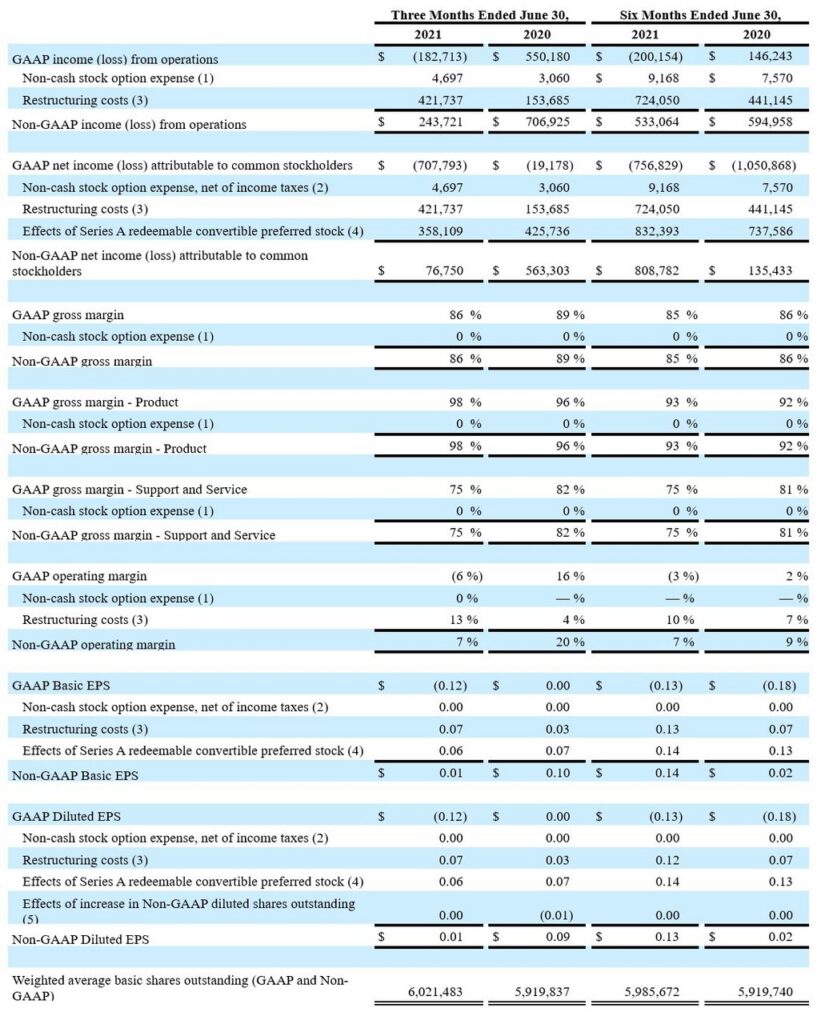

The non-GAAP financial measures used in this press release are not prepared in accordance with generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. The Company’s management refers to these non-GAAP financial measures in making operating decisions because they provide meaningful supplemental information regarding the Company’s operating performance. In addition, these non-GAAP financial measures facilitate management’s internal comparisons to the Company’s historical operating results and comparisons to competitors’ operating results. We include these non-GAAP financial measures (which should be viewed as a supplement to, and not a substitute for, their comparable GAAP measures) in this press release because we believe they are useful to investors in allowing for greater transparency into the supplemental information used by management in its financial and operational decision-making. The non-GAAP financial measures exclude (i) restructuring costs, (ii) effects of our Series A redeemable convertible preferred stock, and (iii) non-cash stock-based compensation charges and any potential tax effects. For a reconciliation of our GAAP and non-GAAP financial results, please refer to our reconciliation of GAAP to Non-GAAP financial measures presented in this release.

About FalconStor Software

FalconStor is a data protection technology company enabling enterprises to modernize their data backup and archival operations across multiple sites and public clouds. We deliver increased data security and provide fast recovery from ransomware attacks, while driving down an enterprise’s data storage footprint by up to 90%. As an established technology leader with 39 issued patents and six patent applications, we have over an exabyte of data under management and offer products that are used by approximately 600 enterprise customers. Our products are offered through and supported by a worldwide network of leading service providers, systems integrators, resellers, managed services providers (“MSPs”) and original equipment manufacturers (“OEMs”). To learn more, visit www.falconstor.com and stay connected with us on YouTube, Twitter, and LinkedIn.

#

FalconStor and FalconStor Software are trademarks or registered trademarks of FalconStor Software, Inc., in the U.S. and other countries. All other company and product names contained herein may be trademarks of their respective holders.

Links to websites or pages controlled by parties other than FalconStor are provided for the reader’s convenience and information only. FalconStor does not incorporate into this release the information found at those links nor does FalconStor represent or warrant that any information found at those links is complete or accurate. Use of information obtained by following these links is at the reader’s own risk.

CONTACT INFORMATION

For more information, contact:

Brad Wolfe

Chief Financial Officer

FalconStor Software Inc.

investorrelations@falconstor.com

CONTACT US AROUND THE GLOBE

Corporate Headquarters

701 Brazos Street

Suite 400

Austin, Texas 78701

Tel: +1.631.777.5188

salesinfo@falconstor.com

Europe Headquarters

Rosa-Bavarese-Straße 3

80639 Munich, Germany

Tel: +49 (0) 89.41615321.10

salesemea@falconstor.com

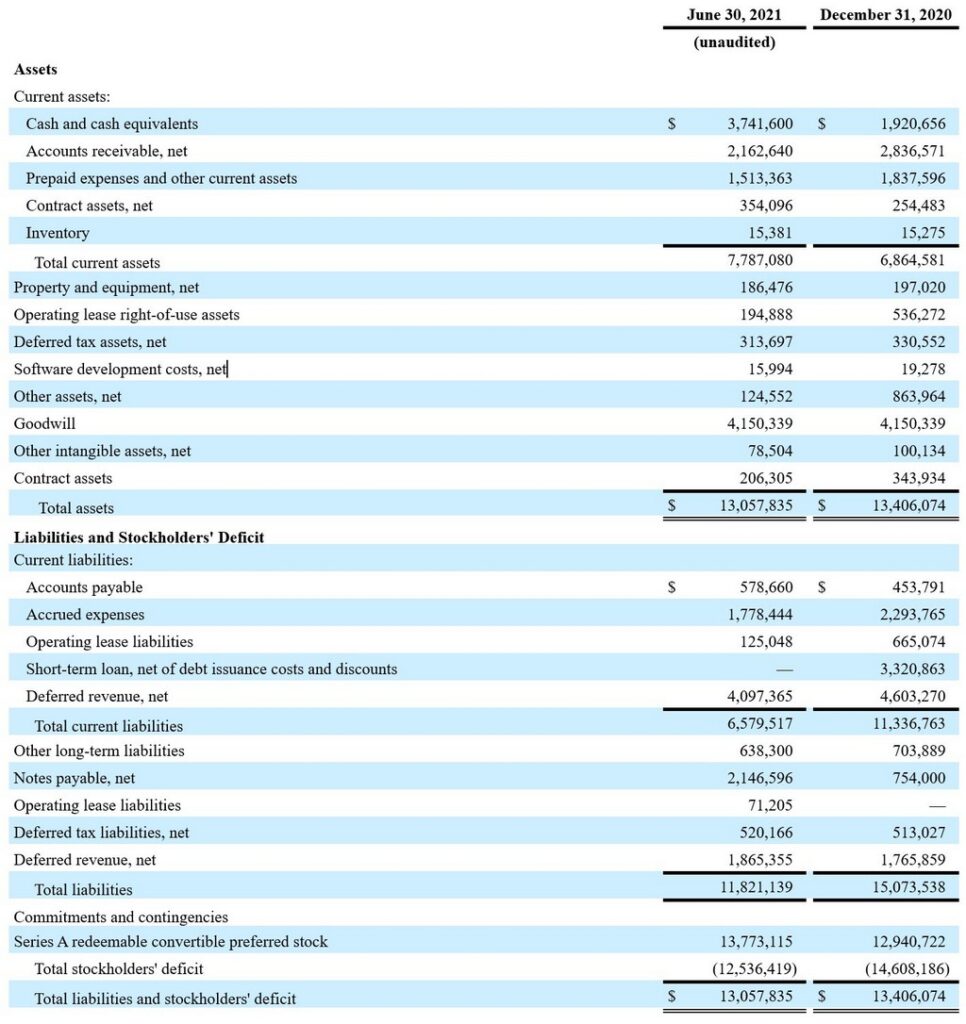

FalconStor Software, Inc. and Subsidiaries

CONDENSED CONSOLIDATED BALANCE SHEETS

FalconStor Software, Inc. and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

FalconStor Software, Inc. and Subsidiaries

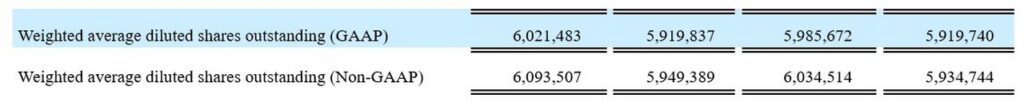

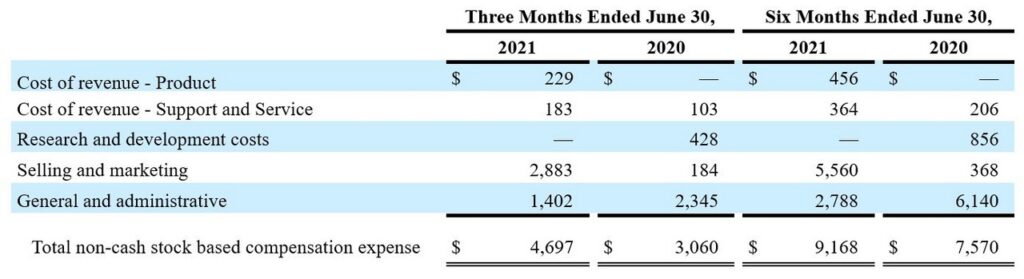

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited)

Footnotes:

- Represents non-cash, stock-based compensation charges as follows:

- Represents the effects of non-cash stock-based compensation expense recognized, net of related income tax effects. For the three and six months ended June 30, 2021 and 2020, the tax expense for both GAAP and Non-GAAP basis approximate the same amount.

- Represents restructuring costs which were incurred during each respective period presented.

- Represents the effects of the accretion to redemption value of the Series A redeemable convertible preferred stock, accrual of Series A redeemable convertible preferred stock dividends and deemed dividend on Series A redeemable convertible preferred stock.

- Represents the impact of an increase in diluted shares outstanding resulting from Non-GAAP adjustments to a GAAP net loss in the six months ended June 30, 2020.